Where is the investment direction during the stagflation period?

- April 2, 2022

- Posted by: admin

- Category: News

Part 1

New Zealand’s economy has reached its most dangerous moment

NO.1 The international economic environment has deteriorated sharply

Since the outbreak of the epidemic in 2020, the economic consequences of the epidemic have become more and more obvious. The variants of the new crown virus are changing with each passing day, and countries around the world are at a loss. They have to cancel the previous mandatory anti-epidemic policies in order to repair the economy damaged by the epidemic. However, the actual situation is that the number of positive infections has increased sharply, resulting in a shortage of labor force; due to the shortage of labor force, the production and transportation of raw materials cannot be guaranteed, and supply chain problems have arisen. The epidemic has caused a shortage of labor and raw materials among the three most basic elements of productivity, while the other element is oversupplied with funds, and the supply and quantity of the three elements are out of balance, causing severe inflation and economic recovery in no time.

The outbreak of the Russo-Ukrainian war exacerbated the deterioration of the world economy. The war and the economic sanctions caused by the war caused the price of energy and bulk raw materials to rise sharply, which made the world economy worse.

NO.2 New Zealand’s inflation rate hits record highs

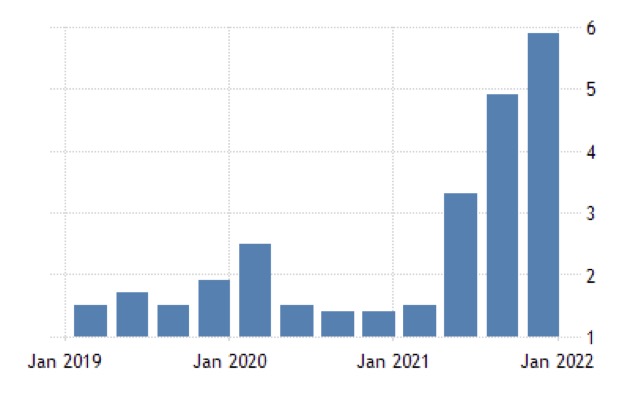

New Zealand latest CPI index

According to data released by Statistics New Zealand in January this year: the consumer price index has risen at the fastest rate since 1990, and the inflation rate in 2021 will reach 5.9%, the highest level in 30 years.

The Reserve Bank of New Zealand forecasts that inflation will peak at 6.6% in the first quarter of 2022.

ANZ economists recently issued a sobering new forecast: New Zealand’s inflation rate will peak at 7.4% and stay there for a long time.

NO.3

The real growth rate of the New Zealand economy is negative

According to statistics from Statistics New Zealand, New Zealand’s economic growth rate in the third quarter of 2021 will be -3.6%, and New Zealand’s economic growth rate will be 3% in the fourth quarter. Although New Zealand’s economic growth rate rebounded in the fourth quarter of 2021, relative to the annual inflation rate of 5.9%, New Zealand’s economic growth rate in 2021 is actually negative.

According to the forecast of New Zealand’s inflation rate in 2022, the negative growth of New Zealand’s economy in 2022 (the actual growth rate after economic growth rate – inflation rate is negative) will continue.

Part 2

It is inevitable that the real estate market will turn from a seller’s market to a buyer’s market

NO.1 High inflation makes higher interest rates an inevitable choice

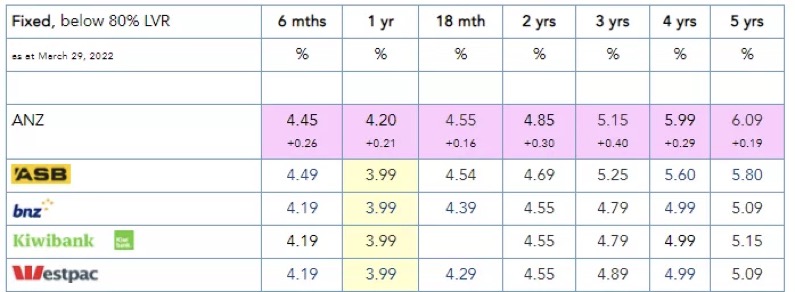

The high inflation of New Zealand’s economy from 1980 to 1990 brought about New Zealand’s economic reforms in the 1990s. In January 1990, New Zealand implemented an inflation target tracking system for the first time: the sole policy goal of the Reserve Bank of New Zealand was to keep New Zealand’s inflation rate at 2% or so, the highest cannot exceed 3%. The most effective means by which the Reserve Bank of New Zealand can achieve this goal is to adjust the OCR. According to the current inflation rate, in order to restore the inflation rate to a level of about 2%, it is inevitable for the Reserve Bank to increase the OCR, and the interest rate rise channel in New Zealand has formed. In the next 2-3 years, the OCR will rise above 3%, and the mortgage rate of the Bank of New Zealand has already reached above 6%. Commercial Bank of New Zealand has raised mortgage rates much faster than OCR. In fact, the 6” era of mortgage loans has arrived. The latest mortgage rates of Commercial Bank of New Zealand are as follows:

NO.2 Interest rates are the most sensitive factor in New Zealand’s property market

New Zealand homebuyers mainly come from bank loans rather than their own cash. The increase in bank loan interest rates directly affects the amount of funds available to homebuyers. From the history of New Zealand’s real estate market, whenever interest rates enter an upward channel, New Zealand’s real estate market begins to change from a seller’s market to a buyer’s market: the market begins to weaken, prices fall, and inventory listings increase; and vice versa.

The most basic principles of economics tell us: the relationship between supply and demand determines the price of commodities. Analysis from the demand side: the rise of interest rates will reduce the money supply, and New Zealand commercial banks will reduce the funds available for lending to home buyers; the rise of interest rates will increase the cost of loans for home buyers, and the borrowers will be able to borrow from banks. demand decreases. For example, when the bank mortgage interest rate is 2%, a house buyer can borrow 1 million yuan plus a down payment of 200,000 yuan, and can buy a house of 1.2 million yuan. When the bank mortgage loan interest rate rises to 6%, the bank can only lend to the house buyer with funds less than 800,000 based on the same loan conditions. With the down payment, the buyer can only choose among the houses below 1 million, then 1.2 million The demand for left and right houses decreases, and when the supply of such houses remains unchanged, prices will also fall. Its downward effect will extend upwards and downwards to affect the prices of houses below 1 million and above 1.2 million, bringing about a downward effect on the overall real estate market. The downward trend of the real estate market will affect the confidence of banks in lending. Banks will further tighten loan conditions, making it more difficult for home buyers to obtain loans from banks, and the amount will be reduced. This will bring about a sharp decline in market demand and make the real estate market enter a downward channel faster.

In the first half of 2021, the real estate market rose irrationally. New Zealand house prices rose by 27.6% in 2021, and the average house price reached 1.06 million. Rising interest rates have had a greater impact on the real estate market than previous weakenings in the real estate market. For example, based on a loan of 1 million yuan, if the interest rate increases by 1%, the average annual interest burden of the borrower will increase by nearly 10,000 yuan. Things are even worse in Auckland.

NO.3 It is inevitable that the New Zealand real estate market will decline

To sum up, the New Zealand real estate market is in an inevitable downward trend. The author has explained this prediction many times in Xinjia Capital’s WeChat official account and WeChat circle of friends after June 2021. The author believes that in the next 2-3 years, the trend of the real estate market will be similar to that of 2018-2019.

The number of people who think now is a good time to buy a home is at its lowest level in the 26-year history of the survey, according to ASB Bank’s latest Housing Confidence Survey.

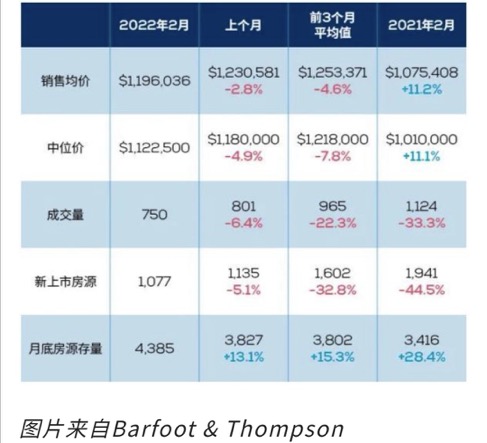

Auckland’s property market is set to cool in the first two months of 2022, according to the latest B&T property sales figures. The firm’s managing director, Peter Thompson, said house prices and transaction volumes were down in February compared to the previous three months.

In order to cope with the changes in the real estate market, Newland Capital has gradually adjusted investment strategies from July to August 2021.For example, in the second half of 2021, the Glenfield real estate development project invested by Newland Capital will seize the time to go on sale for pre-sale. By Christmas in 2021, the pre-sale rate will exceed 83.33%. Before the adjustment of the real estate market situation in 2022, the project profit will be locked at a high level, which reduces project risk.

Part 3

Where is the investment direction during the stagflation period? Introduction of Newland Capital’s countermeasures

In response to the situation in the real estate market, Newland Capital has adjusted its investment strategy to provide investors with more investment options in line with the market environment:

NO.1

Launch the product of Newland REITs-First mortgage

The launch of the product by Newland Capital in 2021 is a timely response to market judgments.

As interest rates rise and bank loan conditions become more and more stringent, investors and developers in the real estate market are less and less likely to get loans from banks. From a realistic point of view, except for self-occupied buyers, investors and developers are less than 10% likely to obtain loans from banks, and the loan needs of these people will completely turn to financial companies. Judging from the current situation, the cost of loan interest rates of financial companies is slightly higher than the cost of similar loans by banks by 2-3%, but the cost of loan time and other hidden costs of financial companies (such as third-party fees such as accountants and lawyers for providing loan materials and The labor cost for companies to prepare these materials) is much lower than that of banks, and the total cost for investors and developers to obtain loans from financial companies is not much higher than that of banks.

Newland REITs-First Mortgage product provides first mortgage loans to lenders with an amount of less than 70% of the collateral value, unless the overall price of the real estate market drops by 30%, the product has no market risk because of sufficient collateral. Newland Capital owns a construction development team, which has one more direct development channel than banks in handling collateral, and there is also the possibility of increasing investment income in the processing of collateral; Newland Capital’s fund custody is entrusted to an independent third party to hold , to avoid the moral hazard of investment.

This product provides investors with an investment income of more than 6% per year (annualized 6% monthly cash return + one-time dividend income when the investment exits).

NO.2

In 2022, Newland Capital will launch a build-hold-lease cash return + capital gain model (Build to Rent)

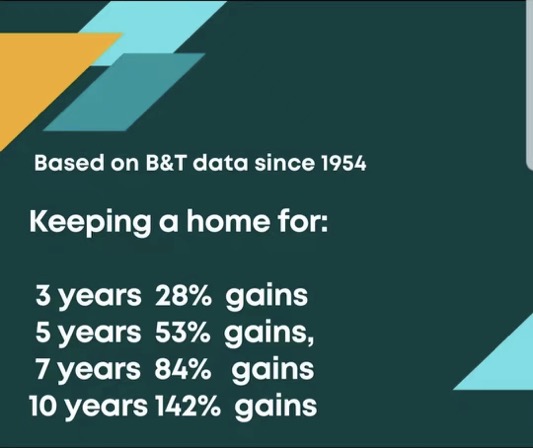

According to the statistics of B&T, the largest real estate sales company in New Zealand, the average annual return of investors with a holding period of three years is 9.33%, and the average annual return of investors with a holding period of five years is 10.6%. The average annual return for investors with a 7-year holding period is 12%, and the average annual return for investors with a holding period of 10 years is 14.2%. In other words, the longer the holding period, the higher the average annual return for investors.

Newland Capital will take advantage of the cost advantages of independent development and construction to increase long-term holdings in Newland REITS product series, and obtain Cash Flow +Capital Gain real estate investment projects, which will bring investors a higher average annual investment return than ordinary real estate investors.

NO.3 Hardcore Technology Venture Capital Project

In 2022, Newland Capital will also launch a hard-core technology venture capital project to provide investors with high-growth hard-core technology equity investment opportunities on the basis of continuous real estate investment and development.

Newland Capital always adheres to the investment philosophy of real estate + takes real estate investment as the cornerstone, and looks for equity investment opportunities with strong growth on the basis of a solid foundation.

On the basis of long-term follow-up investigations, Newland Capital will establish a library of hard-core technology venture capital projects in 2022, and select some small and medium-sized technology companies with core patented technologies in New Zealand to do more detailed due diligence, and when appropriate At the same time, Newland Capital will fully disclose the investment risks of the project for investors who are interested in venture capital to choose.

Newland Capital Management

新西兰金融监管局注册的金融服务商

Registered Financial Service Providers (FSP 761692)

新西兰投资移民签证资金合规项目

Comply with New Zealand Immigration’s “Acceptable Investments” Criteria

新西兰注册建筑大师协会会员

member of the Registers Master Builders Association (RMBA)

长

按

关

注

解锁更多精彩内容

image: Freepik.co

how can we help you?

Contact us at our office nearest to you or submit a business inquiry online.