Some fallen flowers and a flock of swallows

- April 30, 2023

- Posted by: admin

- Category: News

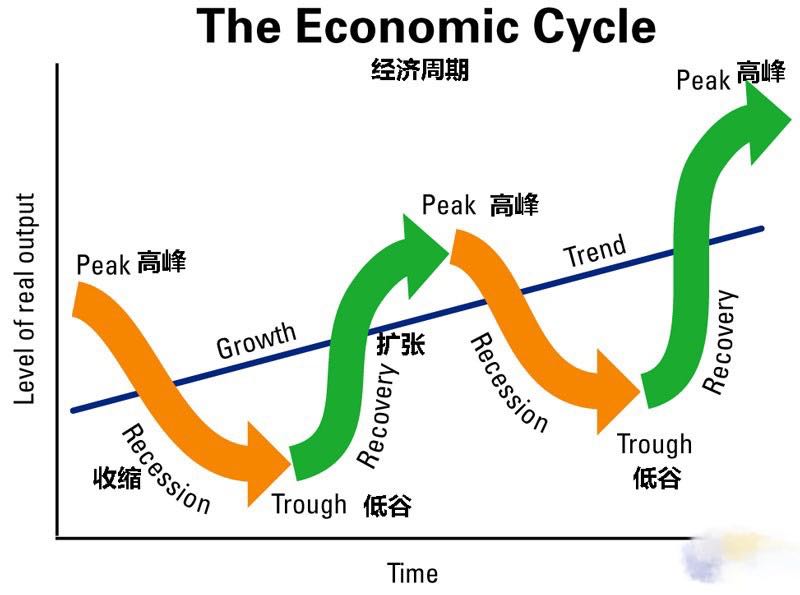

If we consider the two ends of life as darkness, then in the span of several decades in the middle, where there is light, we always have the opportunity to experience once-in-a-millennium, once-in-a-century, once-in-a-few-decades, or even once-in-a-few-years long-term, medium-term, short-term, and even momentary cycles intersecting. Whether it’s economic cycles or technological cycles, in the midst of these seemingly tangible yet intangible events, the framework, branches, and details of our lives are outlined and filled by the guiding hands.

Wealth code for 14600 days

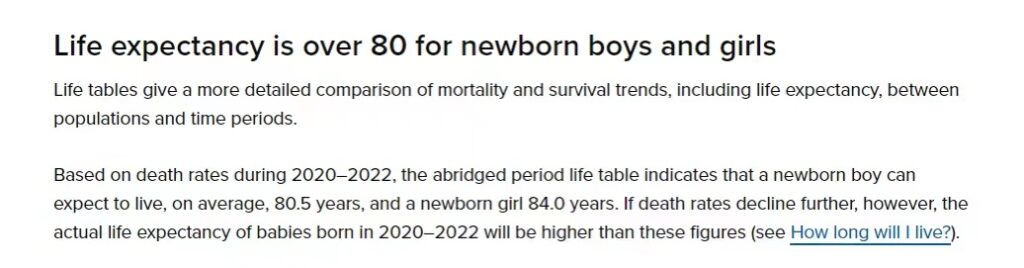

Data released by Statistics New Zealand on February 21, 2023, shows that the average life expectancy for newborn boys in New Zealand is 80.5 years, while for newborn girls it is 84 years. The average life expectancy for both genders is 82.25 years. Calculated on the basis of 365 days per year, the average lifespan is 30,021 days. According to the United Nations statistics on the working age range of 25 to 64, 40 years of working time amounts to only 14,600 days. Financial decisions made during these 14,600 days bear the key to each person’s wealth throughout their lifetime.

Determined Choice

A simple method is to ask yourself quietly before making any financial decision: What will be the impact of this decision on my next three months? What will be the impact on my next three years? What will be the impact on my next thirty years? After asking yourself these questions and obtaining clear answers, you will hopefully be less inclined to compare and worry, and more determined in your choices. You will know that every decision you make is your own, and every day is lived on your own terms. Only in this way can you gradually develop a keen eye for wealth that can withstand the ups and downs of the market, and not be misled by short-term market fluctuations and asset price movements.

OCR Increase

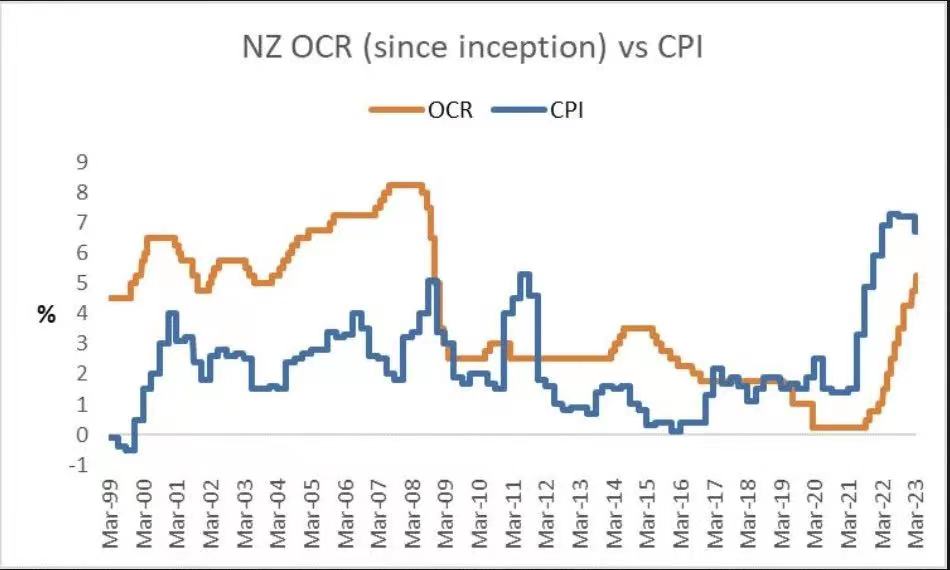

For example, in Auckland during May, the autumn rain falls outside the window, tapping against the ground with the sound of falling petals, marking the end of a splendid season of blooming that followed the peak of summer. Along with the end of this beautiful season also comes the purchasing power that was once supported by the loose pockets of Aucklanders. As the monetary easing policy comes to an end, the Reserve Bank of New Zealand has raised the OCR from 1.0% on April 5, 2022 to 5.25% on April 5, 2023 in just one year.

This round of actions in the market is vividly described as a “violent rate hike”. Under this violent rate hike, too many people have been deeply affected: those who own deposits in major banks, the profiteering class, have suffered greatly from the high inflation that has led to a decrease in purchasing power and a shrinkage of wealth; while the middle class that is overly indebted is forced to reduce expenses due to the soaring housing loan interest rates, and must first use their income to repay bank loans before making any living expenses.

Therefore, there are currently many assets in the market that can be chosen, and their prices are significantly different from those several years ago. If you need money urgently, the asset prices will drop. The prices that were raised during the loose monetary policy period will naturally fall back.

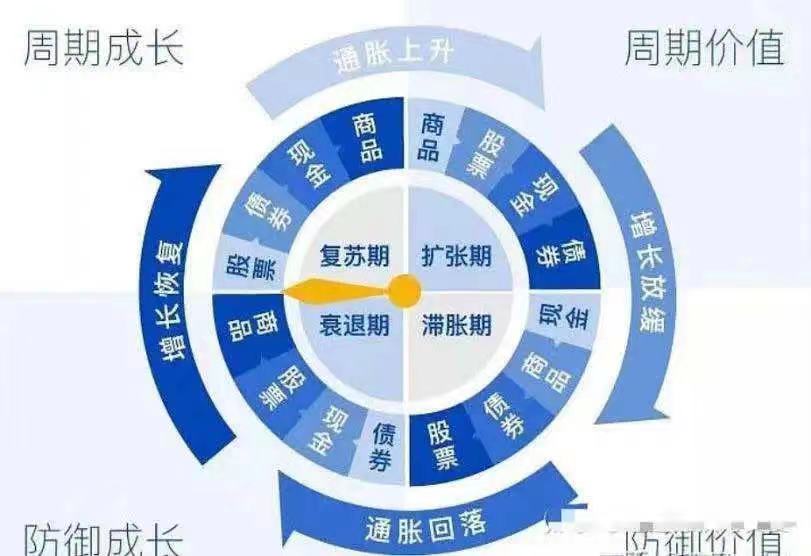

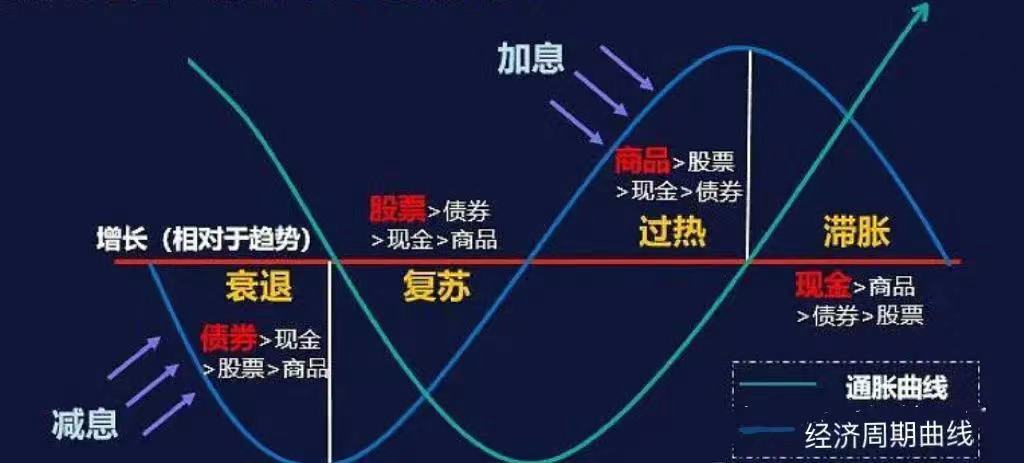

Merrill Lynch clock

There are various opinions on the logic and benefits behind asset allocation in the market. Here, we provide the Merrill Lynch clock as a reference, which is one of the criteria for choosing to switch investment assets.

-

Recovery phase: To stimulate economic growth, the central bank releases liquidity and gradually loosens monetary policy. During this period, the overall profitability of companies may still be at the bottom. However, stocks are more sensitive to the expectation of economic recovery and have a significant excess return relative to bonds and cash. The performance of commodities may still be weak.

-

Expansion phase: The economy moves from recovery to expansion. The growth of GDP or excessively loose monetary policy drives up CPI, and inflation pressures rise. In this macro environment, commodities have a stronger ability to resist inflation, while stocks, bonds, and cash are not good investment choices.

-

Stagflation phase: The issue of prices is closely related to people’s livelihoods. To maintain price stability, the central bank begins to adopt a tight monetary policy, which will have an impact on economic growth. However, CPI remains high, and the tight monetary policy will continue for a period of time. During the tightening process, the investment value of stocks, bonds, and commodities will rapidly decrease. At this time, holding cash (or large-denomination certificates of deposit, money market funds, and other cash equivalents) is a good choice.

-

Recession phase: The tight monetary policy eventually pulls CPI to a low level. At this time, the economy is in a downward channel and demand is weak. Due to weakened profit expectations and no improvement in liquidity expectations, the stock market has no upward logic, and the decline in inflation makes commodities perform poorly. As interest rates decline, bonds become relatively high-quality assets.

The following chart is the line version of the Merrill Lynch clock, which looks more intuitive.

Helpless, the flowers fall away. In the face of our current situation, loose monetary policy is like flowing water, gone forever. Familiar scenes return as the swallows come back, and we are greeted with an increasing number of investment options that offer value. In this larger context and era, switching investment assets is a necessary action for long-term wealth preservation and security.

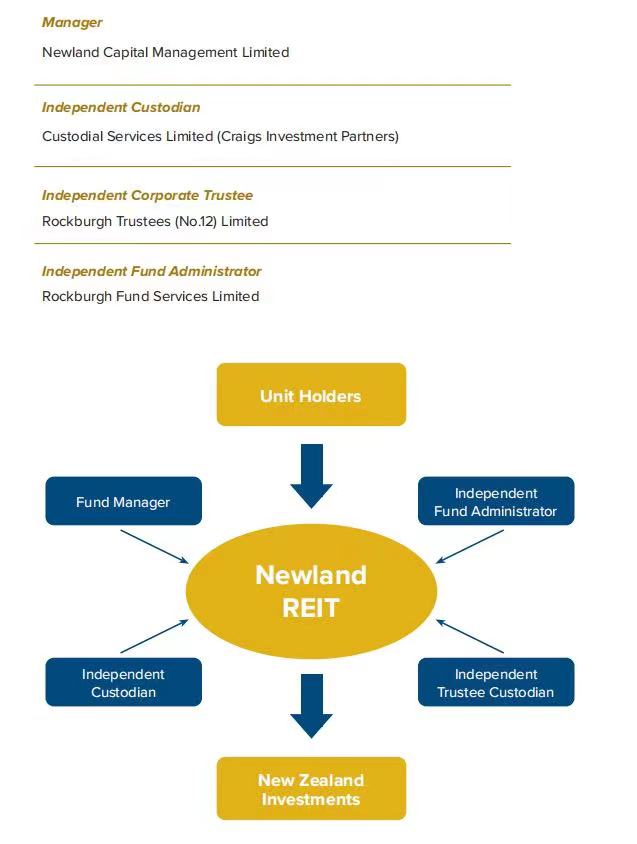

Newland REIT

Newland Capital has always been committed to developing solid and stable investment products. When there are valuable investment assets available, we can quickly organize funds to lock in high-quality assets and thus secure the wealth returns of investors. Our flagship first mortgage loan fund offers a pre-tax annualized return of 8% and monthly dividends, which is commonly referred to as the “never-ending” fund. The investment capital is used to provide first-property mortgage loans, and the dividends are distributed to investors as monthly income for their daily expenses. This is your first choice for long-term wealth preservation. If you are interested in any investment opportunities, please contact Ms. Hannah Zou:022 043 2759。